April 3rd, 2017

How much money… do I need to retire in 2036, at 50 years old?

One second... **pause**... let me rephrase that, “how much money does anybody need… in order to retire for 30-50 years, in today’s day and age? Because for a long time, I think that most people in America looked at it like; 2 million dollars in retirement savings, invested at a 5% annual return, accrues $100,000 dollars per year, in interest alone.

And for many decades that was the, “unwritten standard,” I think, for most American retiree’s.

Yet, this type of investment would compound annually… whereby, if that 100,000$ per year or 5% return on retirement savings… wasn’t fully spent, then the following year that 100,000$ would compound, which was like rocket science to these old people in 1995. But it’s truly fascinating how that works without ever touching the initial 2 million dollars in savings, almost like welfare really. And that is to say that.. IF, you find an investment that pays you 5% per year, on your initial 2 million dollar retirement egg then you could retire fairly comfortably, for many years in America. However, again, without a 5% return on investment, 2 million dollars in retirement savings would actually only allow a retiree $66,000 dollars per year, for 30 years, whereas with a 5% return on investment that same retiree could balloon their retirement savings to something like 4.5 million dollars or more.

And these numbers are of the utmost importance within America today, if your hoping to retire.

But with that being said, I think that most Americans today are aware that deficit spending threatens the future of their Social Security retirement plans and that it’s important to keep in mind… rising costs and inflation. Although, I should also mention that most people don’t save 2 million dollars for retirement anymore, either. And in fact, a majority of retirees in America today, receive over 700 billion dollars in Social Security benefits, per year and often that’s how modern retirement is handled. And in last month’s article, I outlined those statistics; (tTo read last months article click here). Nevertheless, all this means is that elders WITHOUT any retirement savings at all, are currently receiving an average of $1,180 per month, in the form of Social Security retirement. However, these statistics vary, depending upon the amount of taxes each individual paid, during his or her careers.

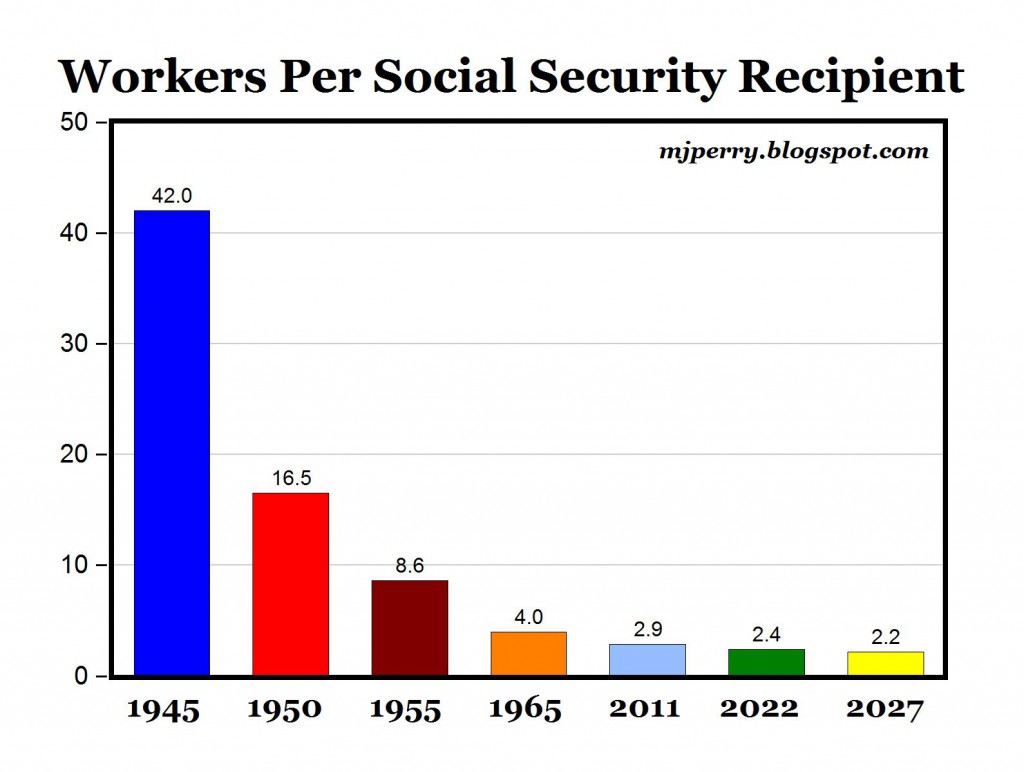

Still, what most Americans aren’t aware of… is that this system of Social Security retirement may one day collapse, meaning that investing your retirement wisely has never been more important.

And today, roughly 70 million Americans (the majority of modern retirees) receive Social Security benefits. Whereby, the age requirement to receive those benefits is currently 62 years old but is that too old and should this system be re-examined? And furthermore, while Social Security is the single most common form of retirement in use today… I also find it safe to assume that most Americans aren’t aware or properly educated, about their retirement options.

But to be clear, the Social Security System may not last. Whereby, a ballooning population of young Americans growing older, in the near future… with over 100 million Americans already in reliance on Social Security benefits, this presents a grave fiscal problem facing our nation.

So how can Americans avoid this fiscal nightmare?

Image result for: “social security running out of money,” via – Google search.

And how much money does it take to retire completely on your own, today, with that in mind? Because specifically, how much retirement money, does a person need to save in order to avoid becoming a, “Social Security statistic?”

Which are very important questions, questions which for many years, particularly in the 1990’s… were simply answered by the 5% interest rate, on investment’s of over one million dollars, which used to be fairly commonplace. However, today’s economic landscape is a bit more rocky for investors to say the least and to be clear, things have changed. So the answer that I personally always felt would solve my retirement needs, was 2 million dollars but again times are changing.

But don’t take my word for it because here’s a very telling perspective, from Jim Cramer, a very well known investment mogul still working on Wall Street today;

Whereby, this quote comes directly from Wall Street…

Cramer: “You’ve got to adopt a Henry Ford attitude here, which is never explain, never complain. You keep your mouth shut during this period, you never complain. Keep your mouth shut during this period, speak softly and wait until the level when the shorts have oversold the stock. That inspires more fear, I don’t want to create fear. I like Bear Stearns very much, but I think that this is not a good call and you shouldn’t say another thing. Just don’t say it. It does not inspire confidence to have 10 headlines telling them what to do, I do not like it.”

Cramer goes on to say;

“This is about Bernanke, he has to be on that call. Bernanke has to open the discount window, that’s how bad things are out there.”

“He has no idea how bad it is out there, he has no idea! THEY KNOW NOTHING!”

“I have talked to the heads of all these firms, just in these last 72 hours AND HE HAS NO IDEA! He has no idea how bad it is out there. My people have been in the game for 25 years and these firms are going to go out of business. THEY KNOW NOTHING!”

“This is a different kind of market and the Fed is asleep.”

“No…. we have Armageddon, in the fixed income markets, we have Armageddon.”

-Jim Cramer, 2011, CNBC’s “Mad Money.”

And this quote, from one of Wall Street’s most experienced brokers, is troubling for a variety of reasons.

But first, this is particularly scary rhetoric, because most retirement funds today are affiliated with Wall Street, in 1 form or another….

And second, because the opening stanza of Cramer’s take is beyond telling, in terms of the attitude which persuaded then President Barack Obama, to wipe Occupy Wall Street under the rug. (Lest we forget, OWS was violently disassembled by police, despite constitutional rights to protest and peaceably assemble in 2011.)

But I repeat… Cramer, working on Wall Street, managing these retirement funds blatantly said; “You’ve got to adopt a Henry Ford attitude here, which is never explain, never complain. You keep your mouth shut during this period. You never complain. Keep your mouth shut during this period. Speak softly and wait t’ill the level when the shorts have oversold the stock. That inspires more fear, I don’t want to create fear.”

But is this rhetoric about YOUR RETIREMENT and YOUR SOCIAL SECURITY PLANS not down right terrifying? And furthermore, this philosophy represents a major generational gap between older and younger Americans… who see’ing their retirement numbers balloon from 2 million dollars to 30-40m dollars, in today’s economy!

Where Jim Cramer is one of the smartest and most respected minds on Wall Street and he’s losing faith in the markets ability to handle mass retirement figures!

So when do we complain? When is it time to say something and how much do I ACTUALLY need, to retire today? Because it seems that that 5% interest rate and 2 million dollar nest egg, are getting lost in the politics…

And this is an especially frightening culture surrounding Wall Street today, particularly in terms of retirement investing. Where this the stance that you want your countries financial epicenter should just play dumb and remain quiet, feels like a change of policy, in many ways…

Yet, no matter what’s happening, just don’t talk about it, he said… and this is in essence an old school mentality that simply cannot last. Whereby, this is the old mentality; don’t talk about politics, don’t talk about money, don’t talk about religion, don’t talk about inflation, don’t talk about retirement, don’t talk about income disparity, don’t talk about an eroding middle class… don’t talk about Occupy Wall Street, don’t talk about the environment, just keep the market moving… until it stops moving, that is!

So how much do we as Americans need in order to retire today? More like 10m at bare minimum and those profit margins are becoming increasingly volatile, even then. But when do we talk about retirement, in the national media? Or… do we just wait until the next generation, “collects Social Security all over again?”

Because long story short, eventually somebody has to talk about it…

-William Larsen, Civilians News, “News For All Views!”